By Alix Poncet.

In the ever-evolving world of luxury goods, geopolitical factors play a crucial role in shaping consumer behavior and market trends but also create challenges in the supply of raw materials. This article focuses on the geopolitical impact on the singular market for diamonds and precious and semi-precious stones.

In 2024, the economy faces potential impacts from geopolitical uncertainties, particularly stemming from conflicts like the Russia-Ukraine war and the Israeli-Palestinian conflict. [1] Moreover, the outcomes of major upcoming elections will likely shape the future global economic landscape. [2] Those in the United States, Argentina, Taiwan, and the EU parliament will be pivotal in shaping the global economic landscape. These elections can mold policies, trade relations, and regional dynamics, influencing investor confidence and impacting various industries. The escalating tensions between China and Taiwan add a layer of complexity, disrupting global supply chains and trade routes. [3]

Geopolitical tensions could induce a wait-and-see approach among households and businesses, potentially hindering economic momentum. [4] Furthermore, concerns about the Chinese economic slowdown, coupled with shifts in political landscapes, contribute to the overall uncertainty. In fact, China’s rise has transformed global politics, shifts in political landscapes under President Xi Jinping include domestic crackdowns, delayed economic reforms, and trade tensions. The “quiet rise” has given way to assertive international postures. [5] The potential for disruptions in the supply chain and fluctuations in commodity prices, including those of rare materials, adds a layer of economic vulnerability that may impact diamond and gemstone transactions. Overall, the intricate interplay between geopolitics, and economic dynamics in 2024 introduces challenges that may impact growth trajectories, investor confidence and transaction values.

The embargo on Russian diamonds

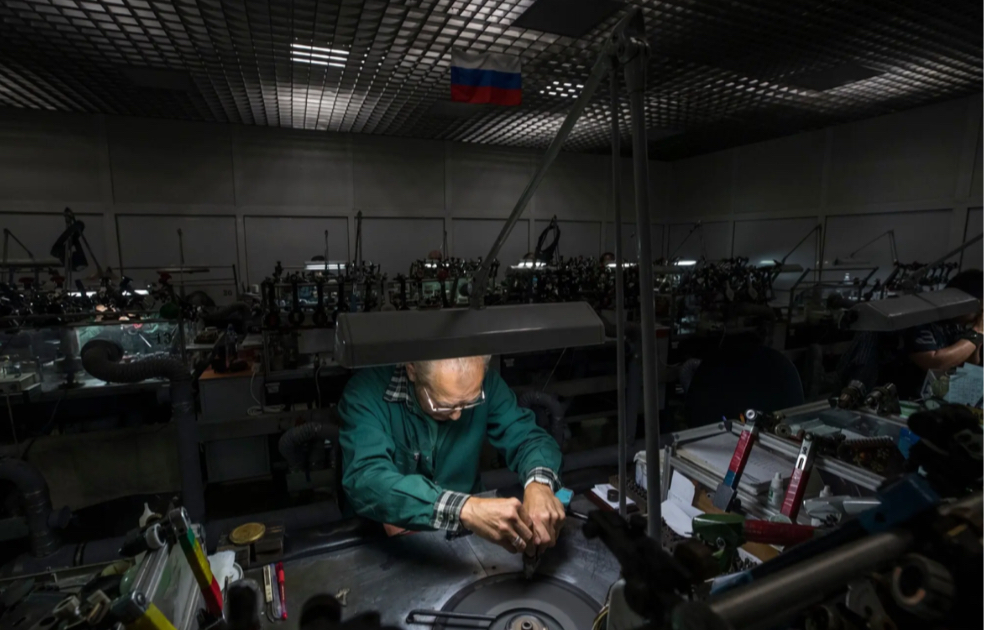

In the intricate world of the diamond industry, the reverberations of geopolitical tensions have recently taken center stage. The fallout from Russia’s incursion into Ukraine has cast a significant shadow, prompting a rapid global response that hit the diamond trade hard. The imposition of an embargo on Russian diamonds, comprising a substantial 28% of the world’s diamond output [6], sent shockwaves through the industry. Subsequent sanctions further intensified the situation, leading to a self-imposed sanction by nearly 1,000 foreign companies, curtailing their Russian operations. [7]

This geopolitical turmoil has laid bare the industry’s susceptibility to political upheavals, emphasizing the intricate dance between global events and the delicate dynamics of the diamond market.

Israel’s War and global market ripple effects

In the ever-shifting sands of global geopolitics, the resurgence of the Israeli-Palestinian conflict is sending shockwaves across international markets, with reverberations felt far beyond its borders. As violence intensified, the complex web of consequences profoundly influenced trade dynamics, gem exports, and ambitious economic corridors. [8]

Israel’s prominence in the gems and jewelry arena cannot be overstated. As a significant technology provider and gem enhancer, it plays a pivotal role in the trade of cut and polished diamonds, constituting the highest exported commodity category at a staggering $1.27 billion. [8] However, the conflict introduces an element of unpredictability, casting shadows over the stability of profit margins and the industry’s resilience.

India’s Diamond Dilemma

India, a powerhouse in the gems and jewelry sector (actively involved in polishing, exporting, and producing, relying on both domestic sources and global extraction), now finds its flourishing trade in precious stones and jewels facing an uncertain future. The conflict in Israel, a key partner in this trade, raises immediate concerns. With West Asia accounting for a substantial 17% of India’s gems and jewelry exports, valued at $37.9 billion in the last financial year, the region’s destabilization could pose challenges for an industry already navigating complexities. [8]

India, housing 90% of the global diamond cutting and polishing industry [9], has urged the G7 countries to postpone the impending ban on Russian diamonds due to unclear rules regarding gem origin tracing. [10] As a crucial player in the implementation of the ban, India is seeking more clarity in discussions with G7 leaders, expressing concerns about the lack of details. The G7 nations had recently announced a direct ban on Russian diamonds, commencing on January 1, with phased-in restrictions on indirect imports starting around March 1, accompanied by a new gem origin tracing system set to be introduced in September. [10] The restrictions aim to curb Moscow’s revenues supporting its invasion of Ukraine.

Russia’s strategic economic diversification in African extracting industries, spanning diamond mining and various minerals, underscores a comprehensive approach to resource acquisition. [11] This diversification strategy aligns with Russia’s broader geopolitical goal of reducing dependency on Western markets and overcoming isolation from sanctions amid the war in Ukraine. Coexisting with China in Africa, both challenge Western influence, reshape the global geopolitical landscape, and leverage economic ties to strengthen their positions on the global stage.

Global Economic Ripples

As the violence escalates, it’s not just the gems and jewelry trade that stands on shaky ground. The broader implications for global markets are starting to surface. The surge in shipping costs, potential disruptions to trade routes, and the increase in risk premiums paint a picture of economic uncertainty. The Israel-Palestine conflict jeopardizes the India-Middle East-Europe Economic Corridor (IMEC), particularly the reliable link between Saudi Arabia and Israel, impacting the envisioned trade route connecting Asia, the Arabian Gulf, and Europe. [12] The rise in oil prices, triggered by conflict-induced anxieties, adds another layer of complexity, affecting not just the gems trade but the overall competitiveness of global exports. [13]

The Ambitious Economic Corridor at Risk

Beyond immediate trade concerns, the conflict jeopardises the ambitious India-Middle East Economic Corridor. Envisioned by Saudi Arabia, UAE, Italy, Germany and France along with the European Union and USA as a strategic network connecting India to Europe through the Middle East, this corridor now faces the looming threat of derailment. Israel’s participation in this corridor, along with other key nations in the region, could be strained by the deepening political divide brought about by the conflict. [14]

India’s Role and Global Collaborations

India, holding the presidency of G-20, finds itself in a unique position to influence the de-escalation process. The global community looks towards the upcoming virtual summit in November for potential interventions. [15] Amidst the geopolitical turbulence, the consequences for global collaborations and economic stability hang in the balance.

Diamonds influence diplomatic relations over time

In a gripping and staggering story spanning three decades, the theft of a Saudi king’s blue diamond by a daring Thai gardener triggered a series of murders and strained diplomatic relations. This vacuum-packed heist of precious stones, worth $20 million [16], has left a lasting impact on international relations. The unsolved mystery, which includes missing diamonds and gruesome murders, symbolises the complex influence of precious stones on global alliances. Saudi Crown Prince MBS’s recent visit to Thailand hints at a diplomatic thaw, weaving an anecdotal tale of intrigue, crime, and the enduring power of diamonds in shaping geopolitical landscapes. [16]

The Dark Side of Burma’s Sparkling Trade

In Burma’s gemstone industry, the military junta’s oppressive rule casts a shadow over the world’s finest rubies and jade. The 1962 coup ushered in direct military control, which persisted until the official dissolution of the junta after the 2011 general election. [17] However, in February 2021, the Tatmadaw detained key leaders, disrupting the transition to a civilian government. A one-year state of emergency was declared, with Min Aung Hlaing assuming leadership as the Chairman of the State Administration Council and taking on the title of prime minister in a caretaker government.

The State Peace and Development Council (SPDC) not only dominates the mines but also has a direct hand in major gem businesses. Forced labor, child exploitation, and unsafe conditions plague the mines, creating a sinister backdrop to the gem trade. [18] As the SPDC relies heavily on gem sales for hard currency, global efforts have emerged to curb this trade through targeted sanctions and boycotts. International jewelers, including Tiffany & Co. and Leber Jeweler Inc., have taken a stand against Burmese gems. Following the military’s seizure of power in Myanmar on February 1, life in jade-producing regions has become increasingly perilous. Valued at $31 billion in 2015, Myanmar’s jade industry, labeled as a potential “biggest natural resource heist in modern history” by Global Witness [19], faces heightened dangers amid clashes between the Kachin Independence Army and the Tatmadaw. Sanctions imposed by the United States and the European Union on entities reflect growing concerns over control of the jade mines. [19] This clash between the glittering allure of precious stones and the grim reality of human rights abuses is reshaping the dynamics of the global gemstone market, forcing consumers and businesses to confront the ethical implications of their purchases.

A Shifting Landscape in the Gemstone and Diamond Market

The gemstone and diamond market is undergoing a profound transformation, driven not only by glittering aesthetics but also by the pressing forces of geopolitics, ethical considerations, and environmental concerns. The stories of conflict and human rights abuses, as seen in Burma, underscore a shifting landscape where the quest for precious stones is intertwined with geopolitical complexities. Global norms, trade agreements, boycotts, certifications, and tracking mechanisms are emerging as pivotal tools to navigate this intricate terrain. The industry, once perceived through a lens of glamour, now grapples with the imperative of ethical sourcing and responsible practices. Armed with information, consumers demand transparency and ethical standards, reshaping their purchasing decisions. As conflicts and geopolitical tensions cast shadows over certain sourcing regions, the gemstone and diamond market is compelled to adapt, embracing practices that address economic considerations and ethical and environmental imperatives. In this evolving landscape, the sparkle of a gem now carries the weight of its journey, reflecting the growing awareness and commitment to a more responsible and conscientious global trade.

Challenges faced by the diamond and gemstone industry present an opportunity for positive change. Geopolitical factors, conflicts, and ethical concerns highlight the need for transparency and responsible practices. As we navigate uncertainties in 2024, driven by geopolitical tensions, embracing innovative solutions like blockchain technology can revolutionize the industry. Blockchain ensures a secure and transparent platform, tracking the journey of precious stones from origin to market and promoting authenticity, ethical sourcing, and sustainability.

Mayada Boulos, (Presidente and CEO of Havas Paris) recommends in a recent article of La Tribune, a crucial shift in corporate strategy, urging the integration of geopolitical responsibility into business practices. Adding a ‘G’ to Corporate Social Responsibility (CSR) becomes essential, reflecting the evolving role of businesses as influential political actors in a world marked by shifting power dynamics. [20]

The call is for the industry to unite in establishing global norms and agreements, led by transparency and facilitated by technologies. Consumers, armed with information and a desire for conscientious purchases, can drive positive change by supporting initiatives prioritizing transparency, responsibility, and geopolitical awareness.

Let’s seize this moment for positive transformation, where the sparkle of a gem represents not just beauty but a commitment to a future marked by ethical considerations, environmental stewardship, and a proactive stance on global issues. Embracing transparency, responsible practices, and geopolitical responsibility, the industry can lead by example in fostering a more accountable and ethical global trade in diamonds and gemstones.

Edited by Justine Peries.

References

[1] Amundi. 2023. ‘Geopolitical Shifts and Investment Implications’, Amundi Research Center <https://research-center.amundi.com/article/geopolitical-shifts-and-investment-implications>

[2] Charrel, Marie, and Béatrice Madeline . 2023. ‘Les Défis Économiques d’Une Année 2024 Soumise Aux Risques Géopolitiques’, Le Monde.fr <https://www.lemonde.fr/economie/article/2023/12/30/en-2024-apres-l-inflation-le-risque-de-la-recession_6208366_3234.html?lmd_medium=al&lmd_campaign=envoye-par-appli&lmd_creation=ios&lmd_source=default>

[3] Salimullah, Farid, and Jason Kirubakaran. 2023. ‘China – Taiwan Conflict: Business Impact and Advisory’, Www.beroeinc.com <https://www.beroeinc.com/blog/china-taiwan-conflict-business-impact-advisory/>

[4] Le, Anh-Tuan, and Thao Phuong Tran. 2021. ‘Does Geopolitical Risk Matter for Corporate Investment? Evidence from Emerging Countries in Asia’, Journal of Multinational Financial Management, 62: 100703 <https://doi.org/10.1016/j.mulfin.2021.100703>

[5] World Politics Review. 2022. ‘How a Rising China Has Remade Global Politics’, World Politics Review <https://www.worldpoliticsreview.com/how-a-rising-china-has-remade-global-politics/>

[6] Impact transform. 2022. ‘Russia: The next Frontier for Conflict Diamonds’, IMPACT <https://impacttransform.org/en/russia-next-frontier-conflict-diamonds/>

[7] OECD. 2023. ‘Responsible Business Conduct Implications of Russia’s Invasion of Ukraine’ <https://www.oecd.org/ukraine-hub/policy-responses/responsible-business-conduct-implications-of-russia-s-invasion-of-ukraine-f222a4d1/>

[8] Jagota, Mukesh, and Sachin Kumar. 2023. ‘Gems and Jewellery Exports Seen to Take a Big Hit from Israel-Hamas War’, Financialexpress <https://www.financialexpress.com/policy/economy-gems-and-jewellery-exports-seen-to-take-a-big-hit-from-israel-hamas-war-3267843/>

[9] Dieterich, Carole. 2023. ‘Under Pressure from Ukraine War, India’s Diamond Industry Tries to Adapt’, Le Monde.fr <https://www.lemonde.fr/en/international/article/2023/04/19/under-pressure-from-ukraine-war-india-s-diamond-industry-tries-to-adapt_6023525_4.html>

[10] Acharya, Shivangi, and Neha Arora. 2023. ‘India Urges G7 to Delay Ban on Russian Diamonds as Rules Lack Clarity Sources’, Reuters.com <https://www.reuters.com/markets/commodities/india-urges-g7-delay-ban-russian-diamonds-rules-lack-clarity-sources-2023-12-20/>

[11] Debates, Raisina. 2023. ‘The Significance of China and Africa in Russia’s Foreign Policy’, Orfonline.org <https://www.orfonline.org/expert-speak/the-significance-of-china-and-africa-in-russias-foreign-policy> [accessed 13 January 2024]

[12] Alias, Afiq Fitri. 2023. ‘Israel Highlights Fragility of New Trade Corridors’, Reuters, section Breakingviews <https://www.reuters.com/breakingviews/israel-highlights-fragility-new-trade-corridors-2023-10-10/>

[13] Disavino, Scott. 2023. ‘Oil Prices up 3% on Worries about Middle East Supplies’, Reuters, section Commodities <https://www.reuters.com/markets/commodities/oil-set-first-weekly-drop-three-mideast-situation-holds-2023-10-27/>

[14] Rizvi, Osama. 2023. ‘From India to Europe: New Corridor Opportunities and Challenges’, Euronews <https://www.euronews.com/business/2023/12/15/from-india-to-europe-economic-corridor-to-offer-new-trade-opportunities>

[15] Chatham house. 2023. ‘The G20 Showcases India’s Growing Power. It Could Also Expose the Limits of Its Foreign Policy’ <https://www.chathamhouse.org/2023/09/g20-showcases-indias-growing-power-it-could-also-expose-limits-its-foreign-policy>

[16] Klaas, Brian. 2022. ‘A Blue Diamond Affair: The Geopolitics of a Heist’, Www.forkingpaths.co <https://www.forkingpaths.co/p/a-blue-diamond-affair-the-geopolitics>

[17] ‘Military Rule in Myanmar’. 2022. Wikipedia <https://en.wikipedia.org/wiki/Military_rule_in_Myanmar>

[18] Human Right Watch. 2008. ‘Burma’s Gem Trade and Human Rights Abuses | Human Rights Watch’, Human Rights Watch <https://www.hrw.org/news/2008/07/29/burmas-gem-trade-and-human-rights-abuses>

[19] Fishbein, Emily. 2021. ‘Military Coup Clouds Control over Jade, Gems in Myanmar’, http://Www.aljazeera.com <https://www.aljazeera.com/news/2021/4/22/myanmar-militarys-lucrative-jade-industry> [accessed 14 June 2022]

[20] Boulos, Mayada. 2023. ‘“Les Multinationales Doivent Se Mêler de Politique” (Mayada Boulos, Présidente de Havas Paris)’, La Tribune <https://www.latribune.fr/opinions/tribunes/les-multinationales-doivent-se-meler-de-politique-mayada-boulos-presidente-de-havas-paris-982917.html>

[Cover Image] Credit Sergei Ilnitsky – Instagram (@ilnitskys)

Leave a comment